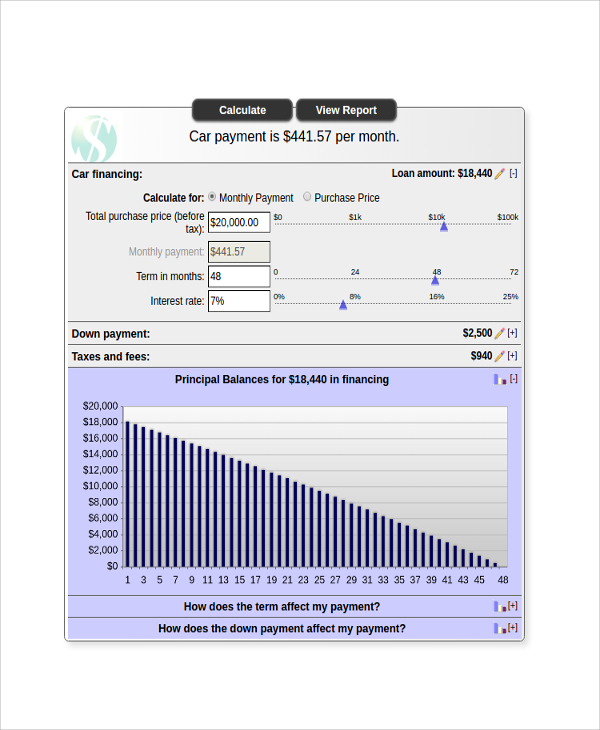

If the calculator you’re using doesn’t include this feature, you can check online lenders and banks for rates. Interest rates : Some auto loan calculators ask for your credit score to help determine what interest rate you may qualify for.Having a shorter loan term means a higher monthly payment but less interest paid overall. In general, choosing a longer term will lower your monthly payment, but you’ll pay more in interest. Loan term : This is the number of months you have to repay your car loan.

This will determine the total loan amount. If a calculator also asks for the purchase price of the vehicle, subtract the value of any down payment, trade-in or manufacturer or dealer discounts and rebates.

Car Loan CalculatorĬalculate and compare monthly car loan repayments. This calculator will help to calculate the lease finance repayments on new business plant and equipment. Business Loan CalculatorĬalculate and compare monthly repayments for a business loan. Boat Loan CalculatorĬalculate and compare monthly boat repayments. Bike Loan CalculatorĬalculate and compare monthly repayments for a motorcycle loan. Fortnightly Mortgage Repayment ComparatorĬompare the effect of paying monthly mortgage payments as opposed to paying fortnightly. Home Refinance CalculatorĬompare the cost/benefits of refinancing your home loan. Simply enter the details and click the button in order to calculate the monthly Car Loan repayment amount.Ĭalculate monthly mortgage repayments on various home loan amounts and interest rates. If you wish to simulate a Car Loan that includes a Residual, please use our Car Lease Repayment Calculator. Note: The Car Loan Calculator does not make allowance for a Loan Residual value. Unlike a home mortgage loan where you monthly loan repayments fluctuate with changing interest rates, car finance loan repaments are generally fixed for the term of the loan.

Term of the Car LoanĬar Loan Finance contracts typically run in the range of 2-5 yrs, however longer and shorter finance terms can usually be negotiated.

#Csr loan calc drivers#

If you are buying a car with either a cash deposit or a trade-in vehicle to offer as a contribution toward the car purchase, the amount left to borrow will be lower.Ĭar loan repayments will be lower with a trade-in or a deposit and, whilst you having equity in the vehicle isn't generally a prerequisite for a car loan, it can make it easier to qualify for car finance in some cases.īad Credit Car Loans and car finance for young drivers are examples of where a deposit or trade-in would make it easier to qualify for a car loan.

#Csr loan calc registration#

Stamp Duty, Car Registration and Comprehensive Car Insurance are examples of on-road costs that you can include. In order to accurately estimate your monthly Car Loan repayments, the purchase price that you enter should include the on-road costs that you will incur on taking posession of the car. Handy hints when taking out a Car Loan Car Leasing - the Pros & Cons Car Loan Repayment Calculator Notes Vehicle Purchase Price

0 kommentar(er)

0 kommentar(er)